South Florida Home Price Increases ‘Could Become Worrisome’

By Paul Owers | 04/23/2021

Tags: Finance | Press-Releases | Real-EstateCategories: Initiatives | Research

FAU Economist: Degree of Overpricing Inches Higher from March to April

Southeast Florida homes are selling for an average of roughly 13 percent more than they should, according to researchers at Florida Atlantic University and Florida International University.

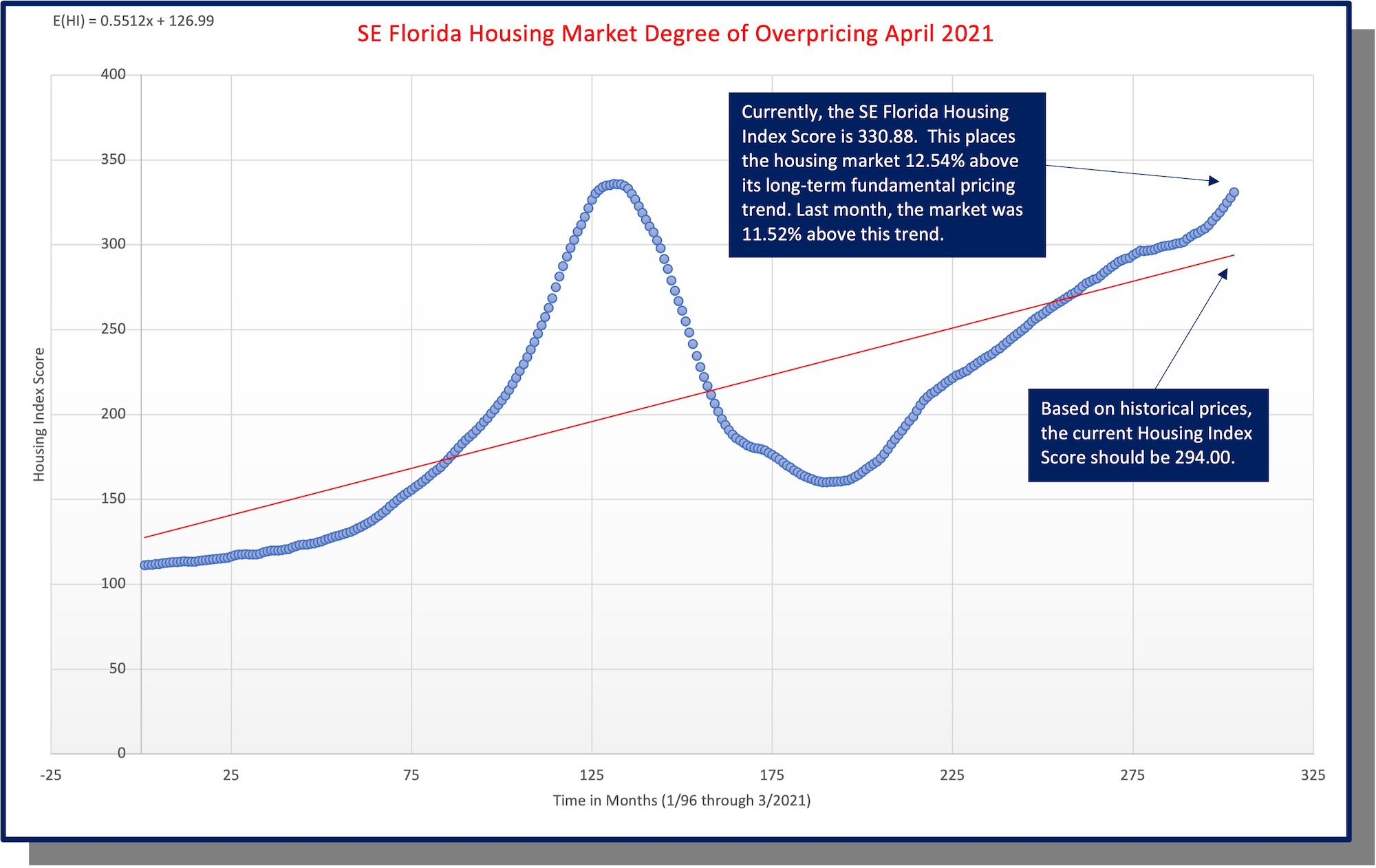

Based on a quarter century of housing data, properties in Palm Beach, Broward and Miami-Dade counties were overvalued by 12.54 percent in April, an increase of more than 1 percent from 11.52 percent in March. While still far below the 65 percent overpricing achieved at the peak of the historic housing collapse of 2007, the size of the month-to-month jump is a concern, said Ken H. Johnson, Ph.D., an economist in FAU’s College of Business.

“Prices are clearly accelerating at a pace that could become worrisome,” Johnson said. “While the reacceleration of prices is extending the current boom, it could cause issues in the local housing market, especially if interest rates should rise because higher rates tend to suppress the demand for housing ownership and therefore housing prices.”

In a recent webinar, Johnson said nearly a quarter of a million people have moved to the Sunshine State in the past year, helping to boost the housing market in the South Florida metropolitan area, the nation’s seventh largest. More people moving to Florida and near-record-low mortgage rates are driving home prices higher, but extending this housing cycle beyond its natural life span could prove problematic in the future, added Eli Beracha, Ph.D., a professor in FIU’s Hollo School of Real Estate.

“You just do not want to grow too fast too quickly,” Beracha said. “All and all, the market still seems sound, but we should keep an eye on the degree of overpricing because it signals the extent to which housing values are exposed.”

The professors analyzed more than 25 years of prices from Zillow.com, the online real estate portal. The Zillow Home Value Index allows for monthly analysis with a three-week lag and includes sales only in the 35th to 65th percentile range, which offers an accurate estimate of local housing trends, according to the researchers. The data cover single-family homes, condominiums, townhomes and co-ops.

Johnson and Beracha also are co-authors of the Beracha, Hardin & Johnson Buy vs. Rent Index. That quarterly housing analysis of 23 key metropolitan areas determines whether consumers will create wealth faster in buying a home and building equity or renting the same property and reinvesting the money they would have spent on ownership.

-FAU-